Commercial Real Estate Debt Funds List

2172014 Real Estate Debt Fund --. Commercial Real Estate and Debt Fund Investment Outlook.

Debt Funds The Rise Of Real Assets Lending Magazine Real Assets

Debt Funds The Rise Of Real Assets Lending Magazine Real Assets

12312000 For funds offering shares to new investors the applicable funds prospectus contains this and other information.

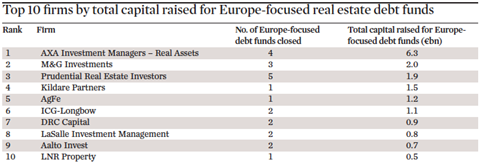

Commercial real estate debt funds list. However the private real estate debt market opened up considerably to alternative. PIMCO raises almost 700m for commercial real estate debt vehicle The asset management behemoth rounded up 697 million for its PIMCO Commercial Real Estate Debt Fund. Real estate debt funds rose to.

Real estate debt funding relies on investors that when they use these types of fund applications receive payments with interest charged against the loan capital. 4212020 As of early April there were a record 939 commercial real estate funds worldwide looking to raise nearly 300 billion to fund debt acquisitions. We use private investor capital to fund loans against California Nevada Arizona Colorado and Texas Commercial Real Estate other States on case by case basis.

DIRECT COMMERCIAL REAL ESTATE DEBT FUNDS Between 2003 and 2010 IMPACT created four direct commercial real estate funds to channel capital to address intractable problems facing communities in need of access to quality healthcare childcare and community facilities. According to Preqin an institutional research firm institutional private debt funds secured 852 billion of global commitments with 496 billion of that total in North America. The fund will focus primarily on high-yield lending on commercial real estate through new loan originations and purchases of legacy loans and securities.

Houses 6 days ago Global real estate debt funds dry powder the amount of capital raised but not invested has piled up to 61 billion as of March 2019 from debt funds commercial real estate. Two of the funds focused on expanding healthcare facilities one on developing new. A real estate debt fund allows borrowers to obtain short-term capital for a variety of different commercial real estate projects which means that the borrowers are almost always developers or experienced real estate investors.

Real Estate Debt Fundraising Debt funds played a very minor role in the private real estate industry prior to the fi nancial crisis with the majority of the aggregate capital raised by real estate funds accounted for by those focused solely on equity Fig. Debt fund financing is one of the most lucrative private equity-backed capital available that lends money to real estate buyers or owners who have real estate assets. Credit across commercial real estate markets in its home market with SKr66 billion 745 million.

Private debt funds. Houses 7 days ago Debt funds that have in-house commercial real estate development and property management capabilities are even better shielded against loss from default or an economic downturn. Commercial Real Estate Debt Fund.

Real estate Show Real Estate. 382016 Private lending has grown every year since and is now a major industry. Real estate debt funds help connect borrowers often developers with short-term capital for commercial real estate projects like multifamily buildings shopping centers construction loans and many other property types.

The investors also get the security charged against the property mortgage or assets. Some of the most common loan types include. Real estate debt funding.

When a loan goes into default these funds can take over the property at a fraction of cost manage the project and. Alex Draganiuk joined the Debt and Equity Finance Group to focus on the firms placement and execution efforts of debt repurchase warehouse and corporate loan facilities mezzanine financing joint venture equity and preferred equity for its commercial real estate developers owners and investors nationwide. The types of real estate projects that are able to be invested in through a real estate debt fund include construction.

The largest real estate debt fund in market is Blackstone Real Estate Debt Strategies III which is targeting 4bn from investors. Real Estate PE Fund Originally Posted. Commercial Real Estate Lending Debtcraft funds First and Second Trust Deeds on Commercial Real Estate.

They work with borrowers who have complex financial situations or do not have access to conventional credit for whatever reason. The average size of closed-end private debt funds rose to a record high of 540 million in 2018 Preqin said. The firm also targets distressed senior real estate credit.

The growth in the number of funds. 03052014 I would like to get input on the likelihood of being able to make a transition to a Real Estate PE fund from a major real estate debt fund investing in debt across the entire capital stack. 3272019 Global real estate debt funds dry powder the amount of capital raised but not invested has piled up to 61 billion as of March 2019 from a low of 12 billion as of December 2012.

27 rows Commercial Real Estate Debt Fund LP. Debt funds can offer commercial real estate borrowers loans and terms that traditional lenders cannot or will not offer.

18 Different Ways To Invest In Real Estate Key Real Estate Resources Real Estate Investing Rental Property Real Estate Investing Real Estate Buying

18 Different Ways To Invest In Real Estate Key Real Estate Resources Real Estate Investing Rental Property Real Estate Investing Real Estate Buying

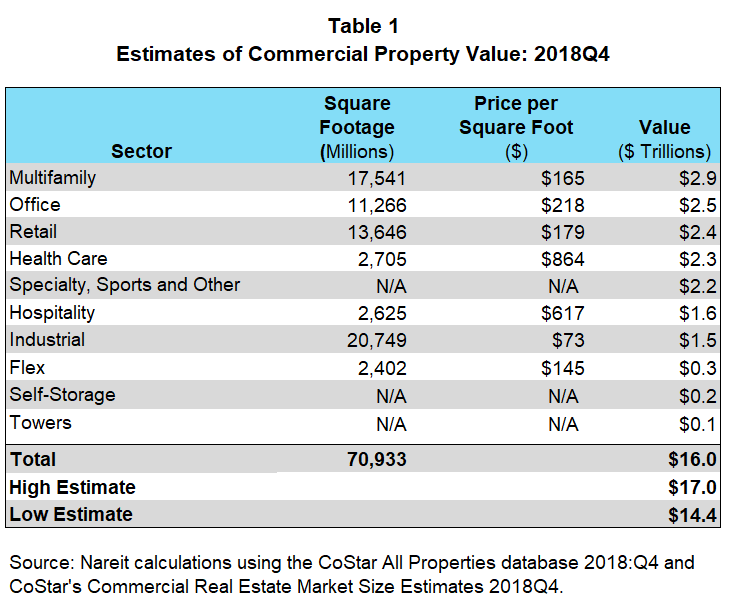

Estimating The Size Of The Commercial Real Estate Market In The U S Nareit

Estimating The Size Of The Commercial Real Estate Market In The U S Nareit

Debt Funds The Rise Of Real Assets Lending Magazine Real Assets

Debt Funds The Rise Of Real Assets Lending Magazine Real Assets

Blackstone Announces 8bn Final Close For Latest Real Estate Debt Fund Realestate Debt Fund Lending Commercialreale Blackstone Fund Commercial Real Estate

Blackstone Announces 8bn Final Close For Latest Real Estate Debt Fund Realestate Debt Fund Lending Commercialreale Blackstone Fund Commercial Real Estate